INTRODUCTION

The financial accounting is one of the useful branch of accounting as it helps company to records monetary transaction occurred on day-to-day basis. Present report deals with importance of financial accounting in business and as such, problems regarding financials are resolved for various clients. Furthermore, suspense and control account are discussed. It can be said that without recording and summarising accounts, business entity cannot prepare financial statements.

A. Report to Line Manager for explaining accounting regulations

|

To: Line Manager From: Junior Accountant Subject: Accounting regulations, concepts and principles to be considered by firm for injecting business operations Respected Sir, Accounting plays crucial role in the business as day-to-day transactions can be effectively recorded and summarised data can be taken out with much ease. It is an art of recording business transactions in accounting books so that each and every information may be accounted for and serve ultimately for preparation of financial statements in the best possible manner. It is required in organisation as it provides fruitful information to the management and external users to take into account information and analyse financials for taking enhanced decisions. It is essentially needed to be prepared by organisation as without it, final accounts cannot be formulated in effective way (Beaumont, 2015). The main financial statements in the business are income statement, balance sheet and cash flow statement which are prepared so that users of accounting information may be benefited quite effectually. Balance sheet provides position of business in terms of assets and liabilities for a particular period. Income statement shows income earned and expenditures incurred in the company. On the other side, cash flow statement shows cash position in effectual manner. This is required so that company may be able to prepare financials in the best possible way. However, for making financials accurate, accounting regulations have to be followed in order to produce fair statements helping stakeholders in taking better decision regarding profitability aspect of company. The accounting principles and regulations are required to be followed, if organisation do not follow the same, then true position cannot be provided to users. False information will be imparted to them affecting their decision-making. By complying with regulations, creditors, investors and other external parties are benefited up to a high extent. Creditors' analyses solvency and liquidity position of company as they provide loans on stated terms and conditions. While, investors' are benefited by assessing profitability aspect of the firm. Hence, it can be said that organisation is required to be abide by laws and regulations so that it may impart appropriate and true financial statements highlighting overall performance (Klychova and et.al, 2015). Explaining meaning of Financial Accounting The financial accounting is termed as gathering past data and then preparing financial statements quite effectually. It is the base for producing financials because accounting records are taken in and then statements are prepared with much ease. All monetary transactions that occurs in the business is accounted for and as such, firm is able to prepare financials in effective way. In simple words, financial accounting is summarising, analysing and then reporting of transactions which pertains to organisation. Hence, they are then provided to stakeholders for taking better decisions quite effectively. The financial reports are prepared which then given to external parties serving them needed information highlighting efficiency, profitability, liquidity and solvency position in the best possible manner. The financial accounting deals with preparation of journal entries which are recorded on daily basis in chronological order. From this, entries are posted in general ledger accounts. After this, trial balance to check over any mathematical errors might have occurred in posting transactions in ledger from journal (Nash, 2018). Hence, afterwards, balance sheet, cash flow statement and income statement are prepared. Thus, financial accounting implies useful information regarding business operations and as a result, internal and external parties are able to take decisions. Discussing Financial Accounting Regulations The regulations are important to be taken into account so that authenticated financials may be prepared with ease. Accounting professional bodies have imparted legal frameworks which are to be followed by accountants in order to construct accurate financial statements highlighting fair and true position of company quite effectually. In relation to this, UK corporate and government regulatory, FRC has given guidelines regarding preparation of final accounts. This will be helpful for external parties as they rely on such statements and take decisions thereof. If accounts are manipulated, then financials will not provide fair view of business (Goh, Li Ng and Yong, 2015). Hence, to eradicate manipulation in final accounts, it is required to follow guidelines of professional bodies. The legal guidelines or frameworks are listed as under- IFRS (International Financial Reporting Standards)- The body provides effective guidelines to accountants so that they may prepare financial reports in accordance to prescribed forma. It is then imparted to the stakeholder for assessing and take decisions. IASB (International Accounting Standards Board)- It is another body which highlights various standards of financial accounting by which information can be presented in proper manner to the stakeholders. Furthermore, true view regarding financials is imparted to external parties. FRC (Financial Reporting Council)- It is a body limited by guarantee and regulates government departments and corporate sector as well. Aim of FRC is to promote investment in UK and as a result, entire country is benefited up to a high extent. Accounting rules The accounting rules are imparted by GAAP (Generally Accepted Accounting Principles) which is another vital body governing accountants in effective manner. The accounting rules provided by the body are as follows- Economic assumption- The accounting rule states that economic environment is assessed by the company and then, assumption are implemented. These assumptions are made in order to find out how it will impact on business operations or on upcoming project (Busco and Quattrone, 2018). Principle of full disclosure- All the monetary transactions should be taken into account so that business may prepare appropriate financial statements. For attaining transparency, all statements must be compiled in single statement. Going concern concept- The business prepares financials on the basis of going concern principle. It is assumed that organisation will continue operations for longer period and will not wind up in short run. Hence, financial statements are produced with much ease. Materiality concept- This concept states that business should take into consideration only material items which has impact over financials. This means that immaterial items can be ignored if they do not serve as the purpose of taking decisions by stakeholders. Monetary unit assumption- This rule is based on currency value. It assumes that business transactions may be made in universally acceptable currency. In relation to this, US Dollar is acceptable currency in worldwide (Damodaran, 2016). Concepts of Material Disclosure and Consistency Material Disclosure- The accounting concept postulates that organisation should include only those items in the financials which affects decision-making of external users up to a high extent. It can be analysed that immaterial items should be ignored which does not influence decision by stakeholders. Hence, such items must be forego in preparing financials in effective way. Consistency- This concept states that accounting policies should be followed consistently for years in order to gain reliability in the best possible manner. It implies that organisation follows particular method in current year, then same should be followed in consecutive coming years. This will impart reliable results in effective way. For example, if written down value method of depreciation is implemented, then same should be used for charging depreciation in forthcoming years to maintain reliability. |

CLIENT 1

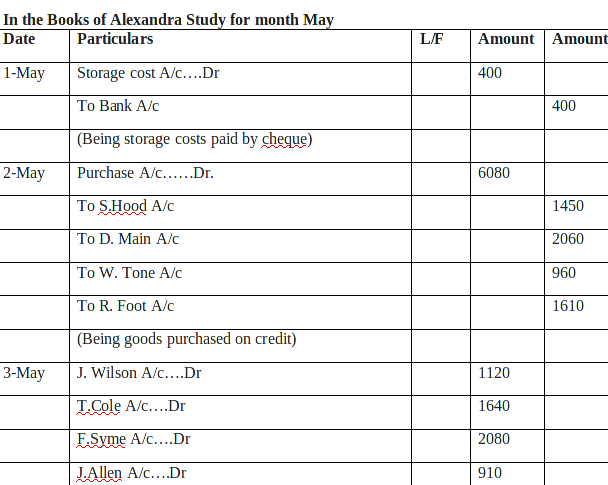

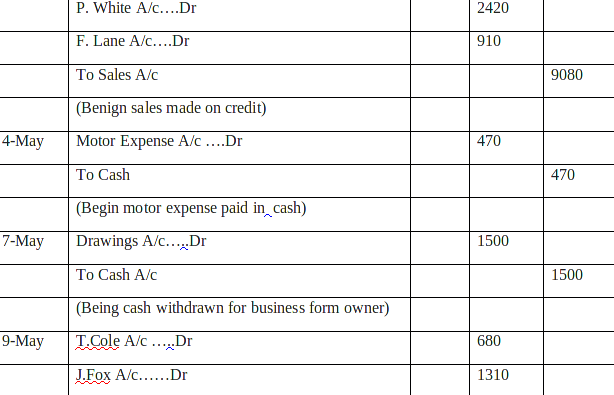

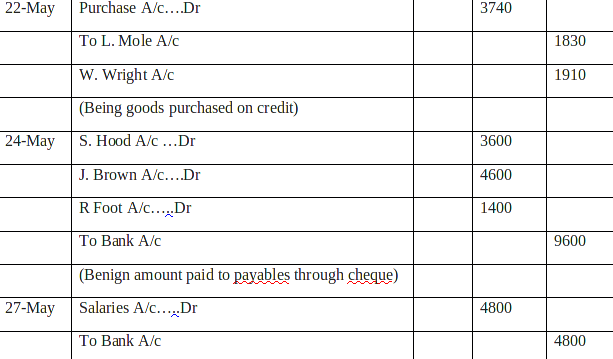

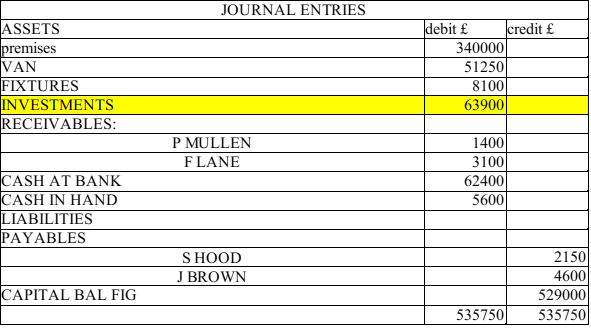

A. Journal entries for Alexandra

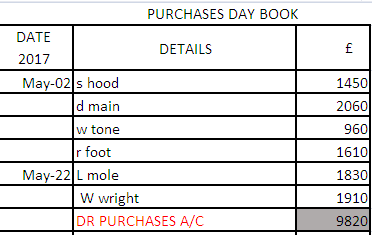

The journal entry is the basic or first step in preparation of financials quite effectually. It is also termed as books of original or prime entry as transactions are recorded on day-to-day basis. In simple words, all monetary transactions occurring in the business is recorded in journal so that clarity may be attained regarding financial receipts and withdrawals in effectual way. The main essence of journal is that entries are recorded as per chronological order as when they occur.

This helps to attain clarity and transparency of various transactions occurred. Hence, it serves main purpose for general ledger accounts and further statements can be prepared with the help of journal entries. These are made for Alexandra below-

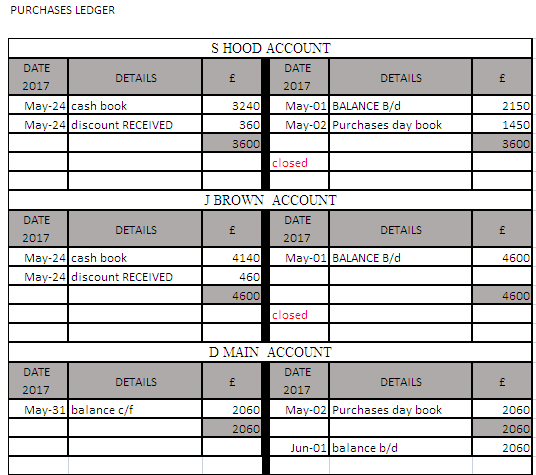

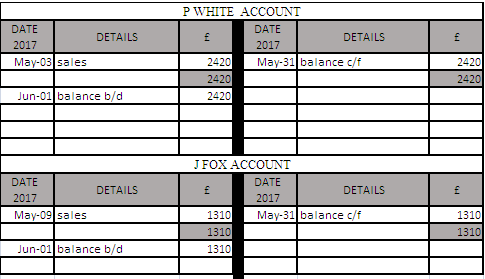

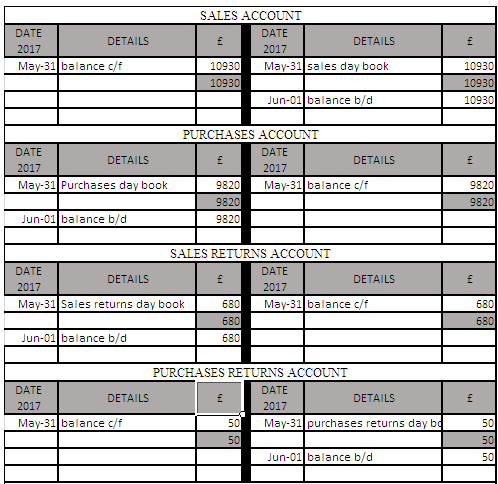

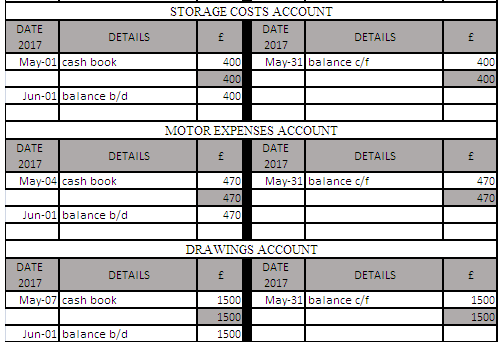

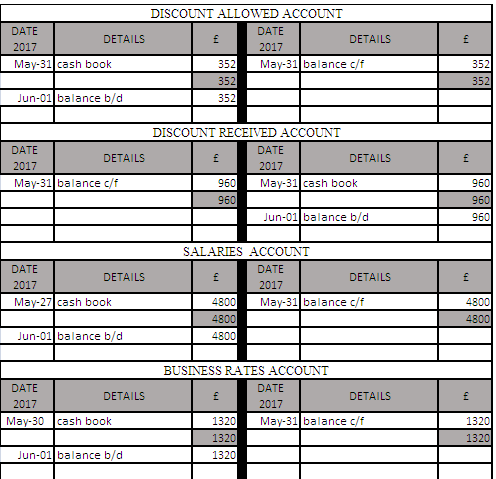

B. Ledger accounts for the firm

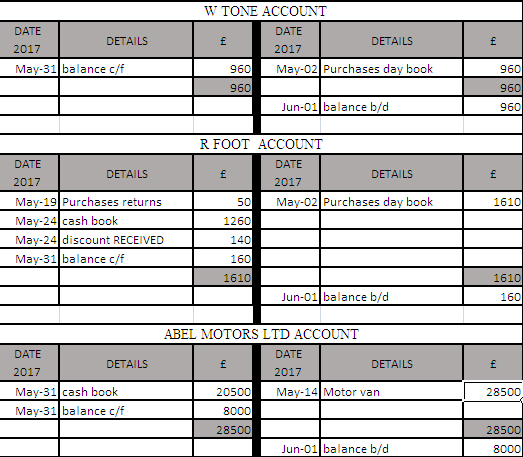

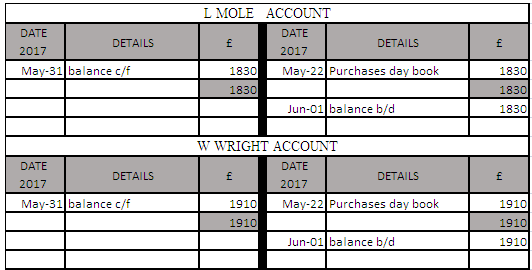

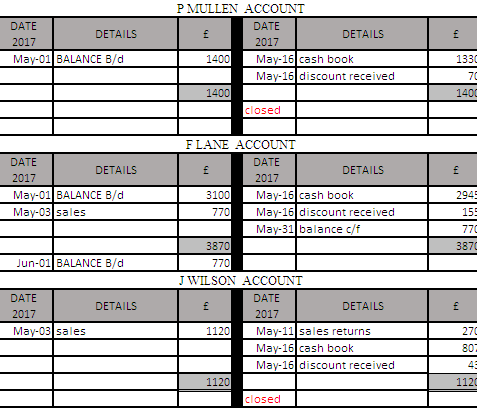

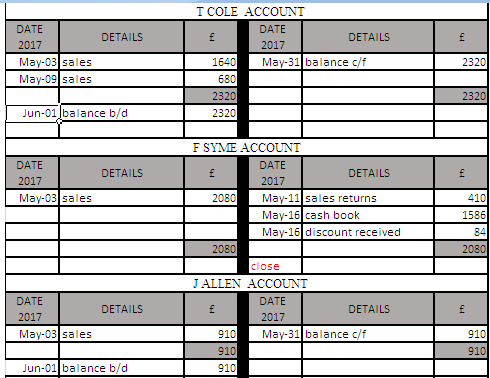

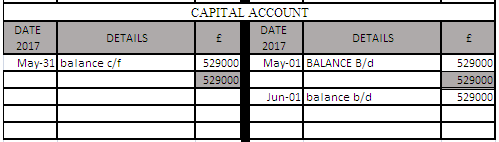

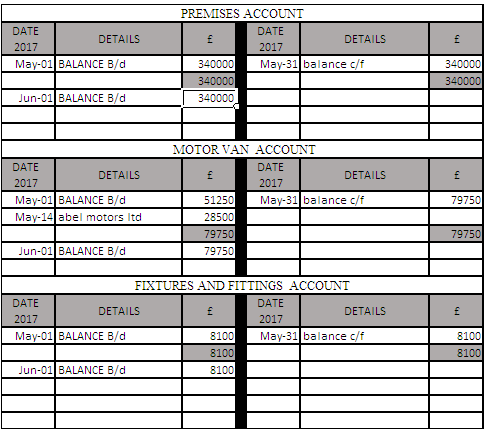

The ledger accounts are prepared from the journal entries made. The ledger is summary of all the accounts which are prepared in the journals. In simple words, separate or individual accounts are formulated with the help of entries are made. The complete detail of information regarding various accounts are ascertained in respect of payments and receipts. This effectively helps organisation's management to take into consideration costs and then measures are adopted to minimise expenditures in the best possible manner. It can be interpreted that ledger accounts are important part of information which is then used for constructing trial balance. The ledger for sole trader are produced below-

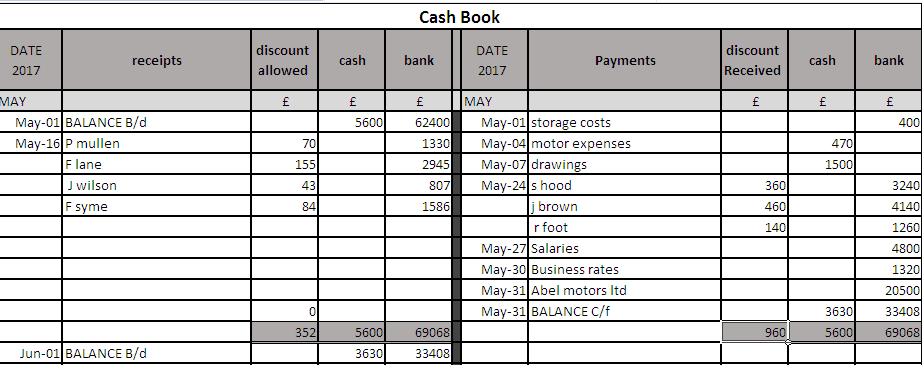

C. Producing trial balance for business

The steps of preparing of journal entries and then posting the same into ledgers are over, then next is to prepare trial balance in effective manner. The main purpose of this statement is to check over arithmetical accuracy so that transactions on both side such as debit and credit are matched properly (Trial Balance, 2018). On the other side, if both balances do not match, then certain errors are present affecting balance on two sides. If from this information, financial statements are formulated, then false information will be imparted and statements will not be appropriate. Hence, to overcome this, trial balance is prepared for rectifying mistakes. It is produced for firm below-

|

Particulars |

Dr |

Cr |

|

Capital |

529000 |

|

|

Van |

51250 |

|

|

Furnitures |

8100 |

|

|

Stock held |

63900 |

|

|

Office Premise |

340000 |

|

|

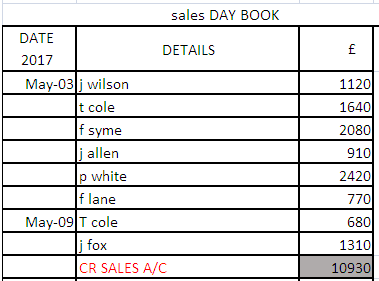

Sales |

10930 |

|

|

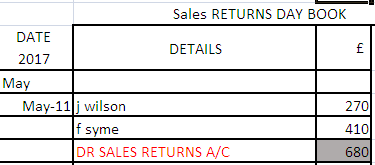

Return inwards |

680 |

|

|

Purchases |

38320 |

|

|

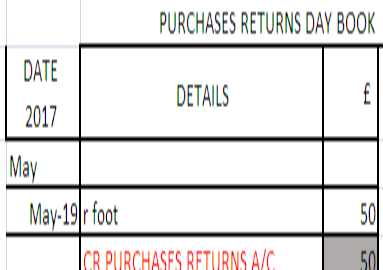

Return Outwards |

50 |

|

|

Drawings made by Owner |

1500 |

|

|

Stock storage costs account |

400 |

|

|

motor expense |

470 |

|

|

Bank Balance |

36700 |

|

|

Cash |

3630 |

|

|

F. lane A/c |

770 |

|

|

Discount received |

960 |

|

|

Miscellaneous income attained |

5132 |

|

|

Discount allowed |

352 |

|

|

Total |

546072 |

546072 |

M1. Purchase and sale transactions from trial balance

The sales are 10930 while purchases are 38320. Thus, it can be said that expenditures are more in comparison to the income earned. This is possible with the help of trial balance.

D1. Consideration of accounting rules and regulations and constructing trial balance

The accounting rules are considered and trial balance is prepared in effective manner. This is prepared to assess mathematical errors if any and as such, trial balance is extracted in a better way.

CLIENT 2

A. Producing income statement

Income statement is useful financial statement which is prepared in order to take into account, all expenses made and revenue garnered. It is formulated to effectively analyse how much firm has gained income by spending on cost of sales and other operating expenditures for a particular year. The income statement is also called as Profit and Loss account as it shows profit earned or loss made in business operations. It can be said that costs are controlled in effective manner with the help of such statement and profits may be maximised up too much extent. The income statement is prepared for sole trader as under-

|

Particulars |

Amount |

|

|

Sales |

1215000 |

|

|

Less: Cost of Sales |

-759360 |

|

|

Salary and wages |

177500 |

|

|

O/S wages and salaries |

1220 |

|

|

Gross profit |

276920 |

|

|

Less: Indirect expense |

||

|

Administration costs |

-17650 |

|

|

motor expense |

-87400 |

|

|

Advertising cost |

-13280 |

|

|

Heating and Lighting cost |

-4950 |

|

|

Less: Prepaid |

8470 |

|

|

Equipments' Depreciation |

-17250 |

|

|

Premises' Depreciation |

-5400 |

|

|

Motor vehicle Depreciation |

-2800 |

|

|

Total indirect expenses |

-140260 |

|

|

Net profit |

136660 |

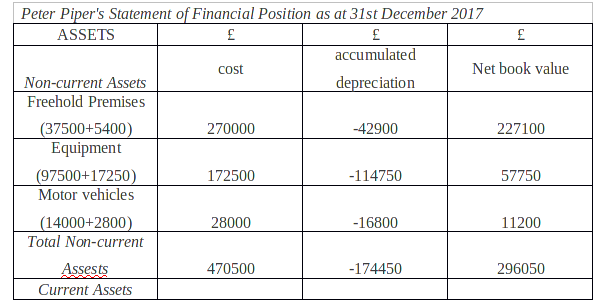

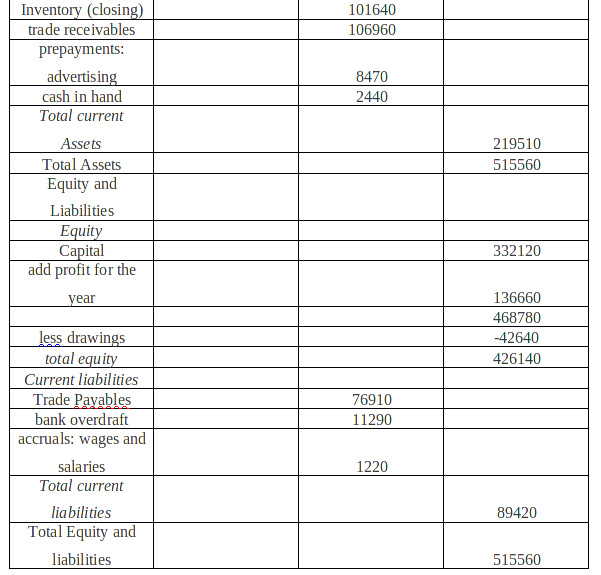

B. Preparing balance sheet for the business

The balance sheet serves as useful piece of information regarding overall financial position of company in the best possible manner. It is a statement showing assets and liabilities for a particular time frame usually it is prepared at the end of financial year. It is used to analyse financial position that whether assets in hand are adequate in meeting out liabilities of company. Hence, balance sheet is useful for assessing health in effectual way. The balance sheet is constructed below-

CLIENT 3

A. Preparing income statement

The income statement highlights position of business with relation to the revenue attained and expenses incurred in a financial year. The statement shows whether income earned exceeds expenditures or not. If income is low and expenses are more, then firm initiates control upon expenses so that income may be maximised. Hence, income statement is formulated for Raintree Ltd below-

|

Particulars |

Amount |

|

|

Revenue |

107000 |

|

|

less: Return inwards |

2000 |

|

|

Closing stock |

18000 |

|

|

Opening stock |

17000 |

|

|

purchases |

32000 |

|

|

Gross profit |

74000 |

|

|

Less: Indirect expense |

||

|

Depreciation (additional) |

36000 |

|

|

distribution expense |

22000 |

|

|

Administration cost |

28000 |

|

|

Less: Prepaid rent |

3000 |

|

|

Add: Outstanding wage |

2000 |

|

|

Corporate tax applicable on firm |

4000 |

|

|

Less: Paid interest |

11000 |

|

|

Net profit |

18000 |

B. Producing balance sheet for the organisation

The statement of financial position is also termed as balance sheet which is prepared to analyse assets and liabilities held at a particular year. The assets should be enough in quantum so that liabilities can be paid off quite easily. The balance sheet shows whether sufficient assets are available to meet liabilities in effective manner (Warren Jr, Moffitt and Byrnes, 2015). Hence, it can be said that balance sheet is useful financial statement is prepared below for organisation-

C. Concepts and principles of accounting

The principles are required to be followed to prepare proper financials. These are listed below-

Consistency-

The consistency concept is quite useful because it states that accounting policies should be followed constantly for years. It is essentially required because when constant changes are made, then reliability is diminished and thus, same methods should be followed by organisation.

Concept of Prudence-

The prudence concept is important one which is used in business. It states that organisation should estimate all losses and gains should not be estimated. This is done because business runs in a dynamic world where changes occur frequently.

D. Importance of charging depreciation and presenting methods of depreciation

The depreciation is charged on asset which reduces its useful life after certain time. Obsolescence is one of the factor in it. Depreciation is an expense and reduces income of entity. Basically, two methods of depreciation are as follows-

Straight line method : It is used to charge depreciation on the basis of fixed rate until life of asset is equal to zero. This means that fixed rate is accounted for.

Written down method : The method is completely different from straight line method which is based on diminished value. This method is preferred and accounted by tax department as correct measure of depreciation is charged.

M2. Evaluating balance sheet and cash flow statement and income statement

The financial statements provide effective way of information to the stakeholders so that they may be able to take into account these informations and take financial decisions in effective manner (Schneider, 2018). On the other hand, they are able to analyse whether company is earning profits or not.

D2. Accurate computations in accounting

The calculations are required to be accurate so that financials may be matched in effective way. Assets held are 137000 and shareholders' equity are 102000 and hence, liabilities equals 137000.

CLIENT 4

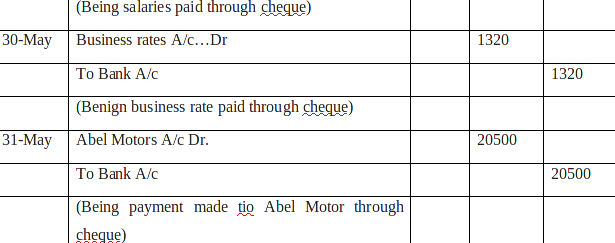

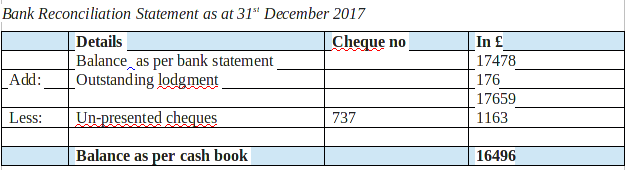

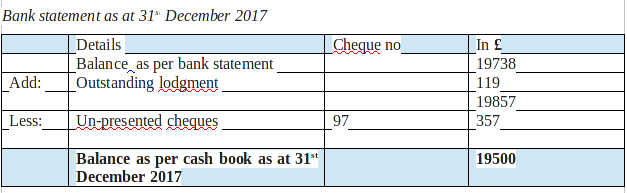

A. Producing bank reconciliation statement

There are various reasons by which balances differs of bank's records and that of accounting records maintained by organisation. In order to rectify the same, bank reconciliation statement is prepared to effectively account for differences up to a high extent. Furthermore, if cheque is provided to bank, organisation records it. While, bank does not clear off the cheque on the same day. Thus, discrepancies occurs and bank reconciliation is prepared to remove the same (Robson, Young and Power, 2017).

B. Outlining causes of recording transaction in statement

The causes are cheques outstanding, dishonoured cheque, deposit in transit are some of reasons for which differences occur.

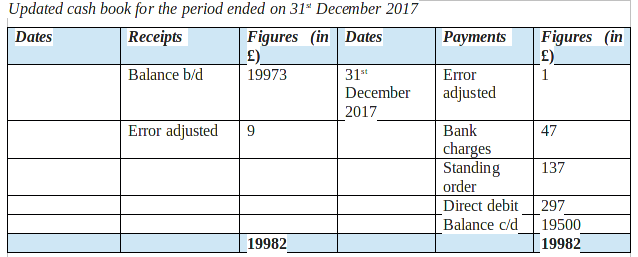

C. Cash books

M3. Process of reconciliation and accounting terms

- Cheques outstanding- When cheque is presented but it is not cleared by bank, balances in records of business entity and of bank differs.

- Deposit in transit- It includes coins and currencies which are not taken into account by bank and thus, balances differs.

- Insufficient funds- The dishonoured cheques are included in it because of unavailability of required funds in the bank account. Hence, it should be written-off as early as possible.

D3. Bank reconciliation statement

The concepts are ratio analysis, trend analysis etc in preparing bank s